Working in the Gulf as a hospitality professional can be both exciting and financially rewarding. With booming tourism, luxury hotels, and a demand for skilled professionals, many individuals from around the world move to countries like the UAE, Qatar, Saudi Arabia, and Oman for lucrative job opportunities in the hospitality sector.

Thank you for reading this post, don’t forget to subscribe!However, living abroad comes with its own set of challenges. High living costs, cultural adjustments, and the temptation to overspend can make saving money difficult. For hospitality professionals, financial planning is not just about surviving—it’s about maximizing earnings, building a secure future, and being able to send money back home.

This article will guide you step by step on how hospitality workers in the Gulf can save money, manage salaries effectively, invest wisely, and achieve long-term financial security.

Understanding Your Salary in the Gulf

Before you start saving, it is essential to understand your salary structure, allowances, and deductions. Hospitality salaries in the Gulf vary widely depending on your position, experience, and the country you work in.

Typical Salaries for Hotel Staff

| Position | Average Monthly Salary (USD) | Benefits/Allowances |

|---|---|---|

| Housekeeping Staff | 500 – 900 | Accommodation, transport |

| Food & Beverage Staff | 600 – 1,200 | Meals, tips, transport |

| Front Office/Reception | 800 – 1,500 | Housing allowance |

| Supervisors/Team Leaders | 1,200 – 2,500 | Housing + transport + gratuity |

| Department Managers | 2,000 – 4,500 | Accommodation + health insurance |

| General Manager/Executive | 5,000 – 12,000+ | Full benefits + bonuses |

Note: Salaries vary across UAE, Qatar, Saudi Arabia, and Oman. UAE and Qatar generally offer higher pay due to cost of living.

Allowances and Benefits

- Housing Allowance: Some hotels provide free accommodation or a monthly allowance.

- Transportation: Staff buses, car allowances, or fuel subsidies.

- Meals: Subsidized or free meals during shifts.

- Gratuity: A lump-sum payment upon completion of service, regulated by labor laws.

Understanding these components will help you budget wisely and identify potential areas to save.

Budgeting for Everyday Expenses

A practical budget is the foundation of financial security. Hospitality professionals often work long hours, and without careful planning, expenses can quickly spiral out of control.

Accommodation

- Option 1: Staff housing provided by the hotel.

- Option 2: Renting independently.

Tips to save:

- Choose shared accommodation to reduce costs.

- Consider locations slightly away from city centers if commuting is manageable.

- Always include utilities in your budget.

Example Monthly Accommodation Budget (UAE, Dubai)

| Type | Cost (USD) |

|---|---|

| Shared room in staff housing | 150 – 300 |

| Studio/apartment | 500 – 900 |

| Utilities (electricity, water) | 50 – 100 |

Food and Groceries

Eating out frequently can quickly eat up your salary.

Tips to save:

- Cook meals at home whenever possible.

- Buy groceries in bulk from supermarkets like Carrefour, Lulu, or local markets.

- Use apps for discounts and cashback offers.

Example Monthly Food Budget

| Item | Cost (USD) |

|---|---|

| Groceries (basic essentials) | 150 – 250 |

| Eating out occasionally | 100 – 200 |

| Total | 250 – 450 |

Transportation

- Use public transport or hotel shuttle services.

- Avoid owning a car unless necessary, as fuel, maintenance, and parking add costs.

Example Monthly Transport Budget

| Transport Mode | Cost (USD) |

|---|---|

| Metro/Bus/Shuttle | 50 – 100 |

| Personal car (fuel+insurance) | 200 – 400 |

Utilities and Internet

- Electricity, water, internet, and mobile bills can vary depending on usage.

- Tips to reduce:

- Switch off lights and AC when not in use.

- Use prepaid mobile plans for better control.

Example Monthly Utilities Budget

| Utility | Cost (USD) |

|---|---|

| Electricity + water | 50 – 100 |

| Internet + mobile | 40 – 80 |

Saving Strategies for Hospitality Professionals

Saving is more than just cutting costs; it’s about creating a plan that allows you to build wealth steadily.

Emergency Fund Setup

- Aim for at least 3–6 months of expenses in a separate savings account.

- Covers unexpected medical emergencies, job loss, or travel issues.

Short-term vs Long-term Savings

- Short-term: Money for monthly expenses, small emergencies, or planned trips.

- Long-term: Retirement funds, investments, and major purchases.

Tip: Automate savings by transferring a fixed percentage (10–20%) of your salary to a savings account each month.

Using Mobile Apps for Expense Tracking

Apps like YNAB, Money Manager, or Spendee can help track spending and identify areas to cut unnecessary costs.

Smart Banking and Credit Card Tips

Banking wisely is crucial to maximize your salary and take advantage of financial benefits.

Best Bank Accounts for Expats

- Choose banks with low fees, good online services, and easy international transfers.

- Example: Emirates NBD, Mashreq, Qatar National Bank (QNB).

Credit Cards and Perks

- Use credit cards wisely to earn cashback, travel points, or discounts.

- Avoid carrying a balance to prevent high-interest payments.

High-CPC keywords for AdSense: credit cards for expats, travel perks, cashback offers, finance tips.

Remittance and Sending Money Home

Many hospitality professionals send part of their earnings to support family back home.

Cost-Effective Remittance Options

| Service | Fee % | Transfer Time |

|---|---|---|

| Wise (TransferWise) | 0.5–1 | 1–2 days |

| Western Union | 1–3 | Instant/1 day |

| Bank Transfer | 2–3 | 2–5 days |

Tips for Safe Transfers

- Avoid unverified agents.

- Use digital platforms to reduce fees.

- Keep records of every transfer.

Investing While Working Abroad

Even with modest salaries, investing can help grow wealth over time.

Beginner-Friendly Investment Options

- SIPs and Mutual Funds – Regular monthly investments with compounding benefits.

- Fixed Deposits – Low-risk, predictable returns.

- Stocks/ETFs – Higher risk but potential for higher returns.

Risks vs Benefits

- Always invest what you can afford to lose.

- Diversify investments to reduce risk.

- Consider professional advice for complex options.

Side Hustles for Extra Income

Hospitality shifts can be long, but part-time opportunities exist:

- Freelancing (writing, design, translation)

- Online tutoring for students in your home country

- Food delivery or ride-sharing services (if allowed)

- Selling handmade goods or crafts online

These not only increase income but also create financial security in case of emergencies.

Common Financial Mistakes to Avoid

- Overspending on Lifestyle: Avoid the temptation to show off or overspend on luxury items.

- Ignoring Insurance: Medical emergencies abroad can be expensive—always have health insurance.

- Unplanned Loans: Avoid high-interest loans or payday advances unless absolutely necessary.

- Not Tracking Expenses: Without monitoring, even a decent salary can disappear quickly.

Conclusion

Working in the Gulf as a hospitality professional offers tremendous opportunities, but managing finances wisely is crucial. By:

- Understanding your salary and benefits

- Budgeting for accommodation, food, transport, and utilities

- Saving strategically and building an emergency fund

- Using banks, credit cards, and remittance services wisely

- Investing and exploring side hustles

…you can maximize your earnings, secure your financial future, and achieve your long-term goals.

Remember, financial discipline is not about deprivation—it’s about making smart choices consistently. Even small steps, when repeated month after month, can lead to significant savings and wealth over time.

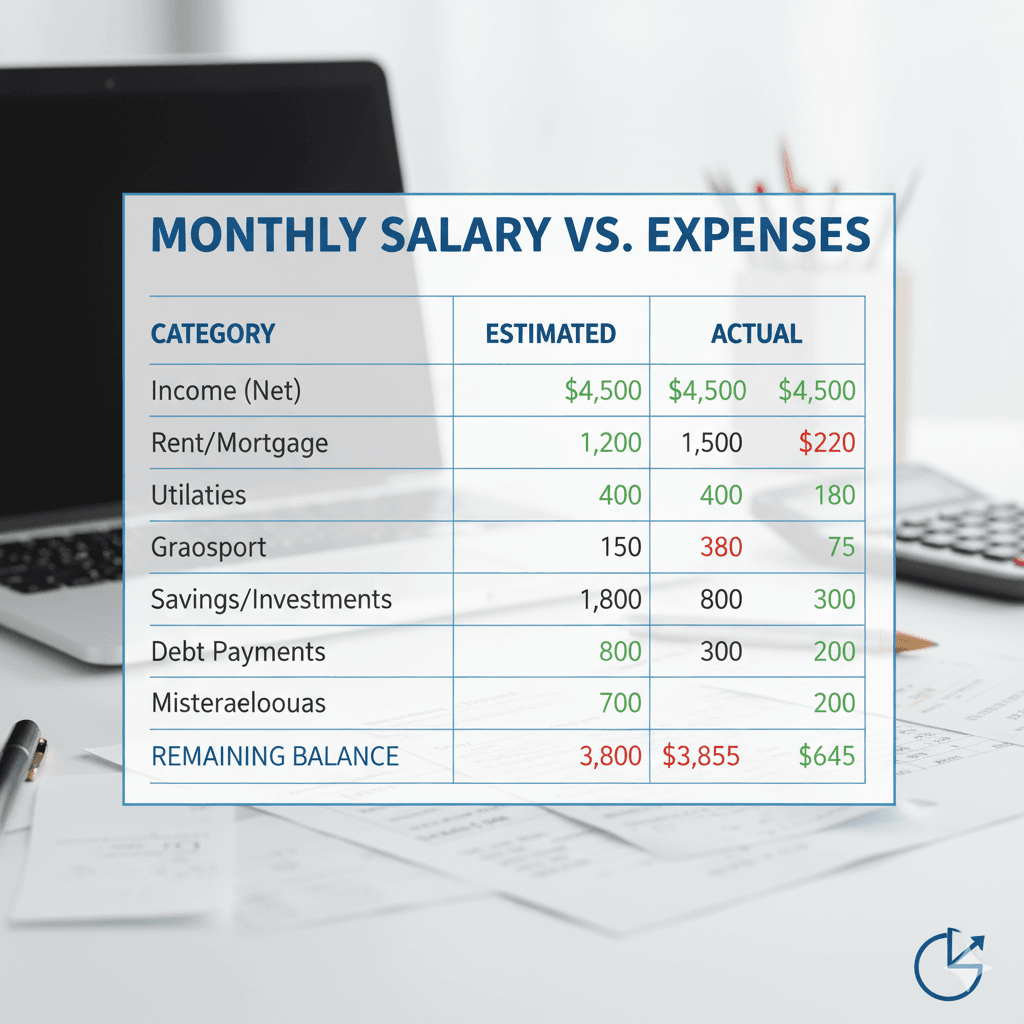

1. Monthly Salary vs Expenses Table

| Item | Cost (USD) | Notes |

|---|---|---|

| Salary (average for mid-level F&B staff) | 1,200 | Includes basic + allowances |

| Accommodation | 400 | Shared apartment/staff housing |

| Food & groceries | 300 | Mix of home-cooked + occasional dining out |

| Transportation | 80 | Metro, bus, or shuttle |

| Utilities & Internet | 70 | Electricity, water, mobile, internet |

| Savings | 200 | 15–20% of salary |

| Remittance | 150 | Money sent home |

| Miscellaneous | 100 | Entertainment, personal care |

| Total Expenses | 1,300 | Slight deficit—adjust savings or cut costs |

2. Budget Distribution Pie Chart

Categories: Accommodation, Food, Transport, Utilities, Savings, Remittance, Miscellaneous

This visually shows how much of your salary goes where.

3. Emergency Fund Growth Table

| Month | Savings (USD) | Cumulative Fund (USD) |

|---|---|---|

| 1 | 200 | 200 |

| 2 | 200 | 400 |

| 3 | 200 | 600 |

| 4 | 200 | 800 |

| 5 | 200 | 1,000 |

| 6 | 200 | 1,200 |

Shows how even small monthly savings grow steadily to cover 3–6 months of expenses.

4. Remittance Cost Comparison Chart

| Service | Fee % | Speed |

|---|---|---|

| Wise | 0.5–1 | 1–2 days |

| Western Union | 1–3 | Instant/1 day |

| Bank Transfer | 2–3 | 2–5 days |

Visual: Bar chart showing fees for each option.

5. Side Hustle Income Example Table

| Side Hustle | Potential Monthly Income (USD) | Notes |

|---|---|---|

| Freelancing (writing, design) | 150–300 | Flexible hours |

| Online tutoring | 100–200 | Language or subject skills |

| Food delivery | 80–150 | Part-time shifts |

| Selling crafts/products | 50–100 | Online platforms |

Monthly Salary vs. Expenses Table (Mid-Level F&B Staff Example)

This table demonstrates a realistic budget scenario and highlights the potential for overspending if not managed carefully.

| Item | Cost (USD) | Percentage of Income | Notes |

| Salary (Net) | 1,200 | 100% | Average for mid-level F&B staff |

| Accommodation | 400 | 33% | Shared apartment/high-end staff housing |

| Food & Groceries | 300 | 25% | Mix of home-cooked + occasional dining out |

| Transportation | 80 | 7% | Metro, bus, or shuttle |

| Utilities & Internet | 70 | 6% | Electricity, water, mobile, internet |

| Savings | 200 | 17% | Target 15–20% of salary |

| Remittance | 150 | 12% | Money sent home to family |

| Miscellaneous | 100 | 8% | Entertainment, personal care, shopping |

| Total Expenses | 1,300 | 108% | Slight deficit—must adjust spending or savings! |

Emergency Fund Growth Table

This table illustrates the power of consistent, automated savings.

| Month | Monthly Savings (USD) | Cumulative Fund (USD) | Goal Status (6-Month Expenses) |

| 1 | 200 | 200 | 16% Reached |

| 2 | 200 | 400 | 33% Reached |

| 3 | 200 | 600 | 50% Reached |

| 4 | 200 | 800 | 66% Reached |

| 5 | 200 | 1,000 | 83% Reached |

| 6 | 200 | 1,200 | 100% Reached (Goal Achieved!) |