Table of Contents

ToggleBest Credit Cards and Banking Options for Gulf Hospitality Workers

If you work in hotels, restaurants, or catering in the Gulf, choosing the right bank account and credit card matters a lot. The Best Credit Cards and Banking Options for Gulf Hospitality Workers guide below explains what to check, which types of cards suit daily life, how to send money home with low fees, and how to avoid debt. I wrote this in simple language so you can read it quickly and use it right away.

Thank you for reading this post, don’t forget to subscribe!Why the Best Credit Cards and Banking Options for Gulf Hospitality Workers matter

Life as a hospitality worker often means long shifts, rotating hours, and tight budgets. When you pick the Best Credit Cards and Banking Options for Gulf Hospitality Workers, you keep more of your salary, get rewards that fit how you spend, and avoid paying unnecessary fees. Small savings add up month after month. Good choices also protect you during an emergency and help you build credit history for the future.

Understand your salary and common allowances

Before you apply for a credit card or open another account, understand the full structure of your pay. Many hospitality roles include a basic salary plus allowances for housing, transport, and meals. Some hotels provide staff accommodation or meals, which lowers your monthly costs. If you know what you actually take home each month you can choose the Best Credit Cards and Banking Options for Gulf Hospitality Workers that match your budget.

Common salary components

- Basic salary

- Housing allowance or staff accommodation

- Transport allowance or shuttle service

- Service charge or tips

- Any employer deductions

What to look for in a bank account

A good bank account is the foundation. For hospitality workers, select an account that has low fees, a good mobile app, and cheap remittance options. Here are the essentials to check.

Minimum balance and monthly fees

Some banks require a minimum balance. If you miss it they charge a fee. Choose accounts with low or zero minimum balance if your salary is modest. This prevents surprise charges.

Remittance costs and exchange rate

If you send money home, the total cost includes both the transfer fee and the exchange rate margin. Small differences in the rate can reduce the money your family receives. Compare the total cost, not just the fee.

ATM network and branch access

Pick a bank with ATMs close to your home or workplace. This saves time and taxi costs. Also check branch hours if you need in-person help.

Mobile app and online services

A clear and fast mobile app helps you check balances, freeze lost cards, make transfers, and pay bills. A good app is a big convenience for busy hospitality staff.

Which banks fit hospitality workers in the Gulf

Banks differ by country, but the best ones for hospitality workers share common traits: low fees, simple account opening, easy salary credit, and cheap ways to send money home. Below are recommended options by country and why they work for hotel and restaurant staff.

United Arab Emirates

In the UAE, choose banks with many branches, low-cost salary accounts, and good remittance partners. These banks also often let you secure a credit card using a fixed deposit if you do not meet the salary rule right away. When your employer deposits salary directly, you may get fee waivers or faster access to card options.

Saudi Arabia

Saudi banks with wide branch networks and efficient remittance services are useful for hospitality workers there. Look for banks with starter accounts designed for new expats and staff who live in shared housing.

Qatar, Oman, Bahrain, Kuwait

In these countries focus on banks with clear fee schedules and local language support. If your family is in South Asia or the Philippines, check whether the bank offers cheap transfers to your home country.

Types of credit cards that suit hospitality workers

Not every credit card is helpful. Hospitality staff spend most on groceries, fuel, and food. Choose cards that reward these categories. Avoid high annual fee cards unless the benefits clearly cover the cost.

Cashback cards for daily spend

Cashback cards that return a portion of spending on groceries and dining reduce everyday costs. If you cook at home and shop regularly, cashback on supermarkets is very useful.

Low income or starter cards

Many banks offer starter cards that need low monthly income. These cards help you build credit. If your salary does not meet higher card requirements, ask the bank if you can use a fixed deposit as collateral to get a better card.

Travel and multi currency cards

If you travel home once or twice a year or make international payments, a card with low forex fees or multi-currency support will save money. Check whether the card charges a fee on foreign currency purchases.

How to compare credit card offers

Comparing cards properly means looking beyond one or two benefits. Check annual fee, foreign transaction fee, cashback categories, reward expiry, and the free interest period. Below is a simple checklist.

- Annual fee and what makes it worth paying

- Foreign currency fees for purchases abroad

- Cashback or rewards on groceries, dining, and fuel

- Interest free days and penalty rates

- Cash withdrawal fees and limits

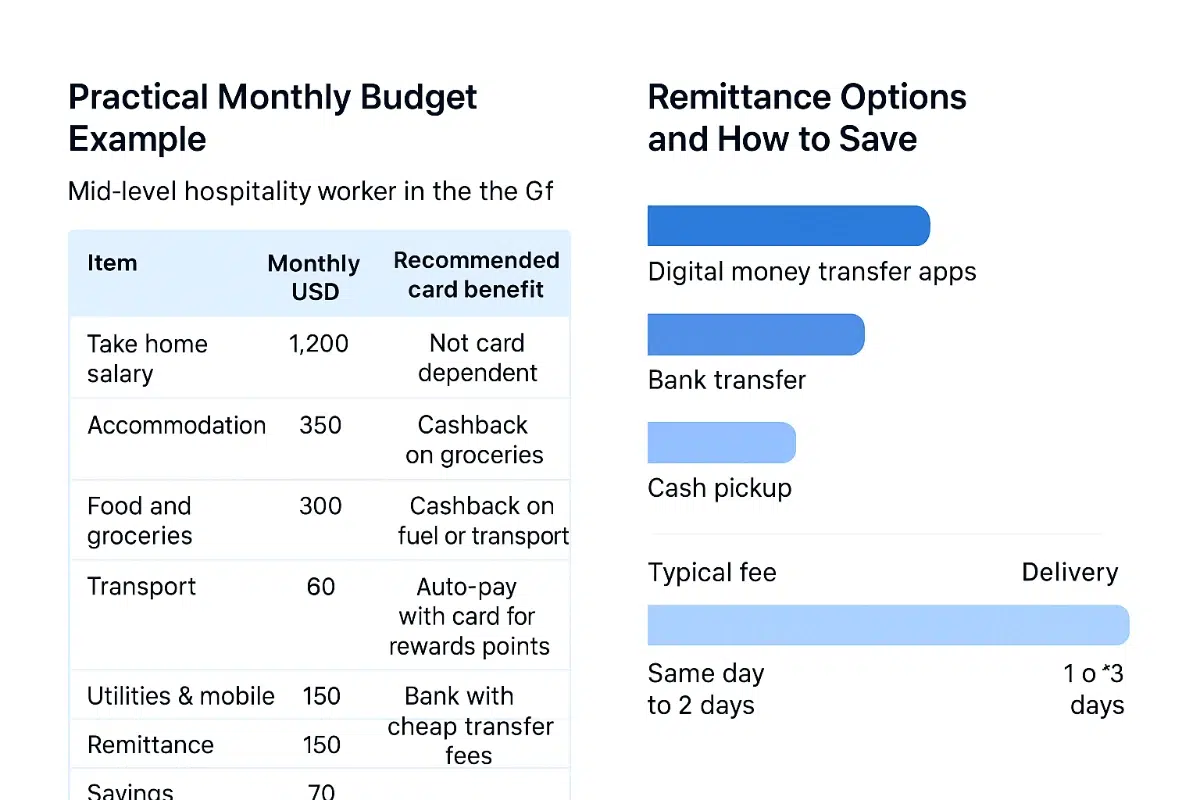

Remittance options and how to save

Sending money home is a monthly cost for many hospitality workers. Use services that show both the fee and the exchange rate so you can compare total cost. In many cases a digital transfer service is cheaper than a bank wire.

| Service type | Typical fee | Delivery |

|---|---|---|

| Digital money transfer apps | Low | Same day to 2 days |

| Bank transfer | Medium | 1 to 3 days |

| Cash pickup | Medium | Instant |

Practical monthly budget example and card fit

Below is a clear budget example for a mid level hospitality worker in the Gulf. It shows which card features will help most.

| Item | Monthly USD | Recommended card benefit |

|---|---|---|

| Take home salary | 1,200 | — |

| Accommodation | 350 | Not card dependent |

| Food and groceries | 300 | Cashback on groceries |

| Transport | 60 | Cashback on fuel or transport |

| Utilities & mobile | 60 | Auto-pay with card for rewards points |

| Remittance | 150 | Bank with cheap transfer fees |

| Savings | 150 | High interest savings account |

| Miscellaneous | 70 | Low or no annual fee card |

Top card features to choose for daily life

The right features save real money. Here are the most useful ones for hospitality staff.

Cashback on groceries and dining

Cashback on groceries is the most practical benefit. A 1 to 5 percent cashback on supermarket spend returns money to your pocket quickly.

No foreign transaction fee

If you make purchases in other currencies or book flights, a card with little or no foreign transaction fee avoids extra cost. Always check the exchange rate used by the card provider too.

Long interest free period

Some cards give 40 to 55 days of interest free credit. If you pay on time, you can use the card as short term free credit and pay no interest.

Low or zero annual fee

A low or zero annual fee card keeps your monthly cost down. Only pay a higher fee if the card’s rewards clearly cover it.

How to use a credit card safely

A card is a tool. Use it wisely and it helps you. Use it without plan and it costs you. Follow these simple rules.

- Pay the full balance each month whenever possible

- Set up payment reminders so you never miss a due date

- Avoid cash advances; fees are high

- Keep utilization low; don’t use the full card limit

- Check your statement every month for errors

How to build credit history while working abroad

A strong credit record helps later when you want a bigger card, a loan for a car, or even to rent a better apartment. Start with a starter card, pay on time, and keep usage low. Over time banks will offer you better cards and lower fees.

Common mistakes to avoid

Many workers make simple errors that cost money. Avoid these to keep your money safe and growing.

- Taking cards with high fees without checking if benefits match your spending

- Ignoring what foreign currency charges add to costs

- Using credit for daily living when salary cannot cover it

- Opening too many accounts and losing track of fees

Which banks and cards to ask about

Names change by market and promotion, but ask these questions at the bank: do you offer a salary account with low balance requirement, which starter cards are there, do you have a cashback card for groceries, and what are your remittance fees? Banks often run promotions that make a mid tier card very cheap for the first year.

Real steps you can take this week

Here are practical steps you can do now to improve your finances and pick the Best Credit Cards and Banking Options for Gulf Hospitality Workers that fit you.

- Review last three payslips to find true take home pay

- List monthly expenses and see how much you can save

- Compare 2 local banks for salary account fees and remittance partners

- Ask your current bank about starter credit cards and fixed deposit security options

- Choose one card with clear cashback in the category you spend most

Frequently asked questions

What are the Best Credit Cards and Banking Options for Gulf Hospitality Workers to start with?

Start with a salary account that has low or zero balance requirement and a starter cashback card that rewards grocery and dining spend. This pair gives practical savings and builds credit.

Can I get a good card with a hotel staff salary?

Yes. Many banks offer starter cards for lower income levels or allow a fixed deposit as collateral to issue a better card. Speak to the bank branch to find options for your exact income level.

How do I reduce remittance cost?

Compare digital transfer services with bank transfers and include the exchange rate in your comparison. Often a digital service gives a lower total cost and faster delivery.

Conclusion

Choosing the Best Credit Cards and Banking Options for Gulf Hospitality Workers is about matching a bank and card to your real life. Pick banks that are easy to reach, offer a strong mobile app, and keep transfer costs low. Pick a card that gives cashback on the things you buy most, has a low annual fee, and charges little for foreign currency.

When you take these steps you keep more of your salary, build credit for the future, and reduce the cost of sending money home. Start with small changes this month and you will notice the savings adding up.